How’s The Market?

When the newsletter came out last month, the Yampa Valley had not received much springtime precipitation. As anyone paying attention to the verdant landscape can attest, we’ve had a lot of rain to keep things very green and colorful well into June.

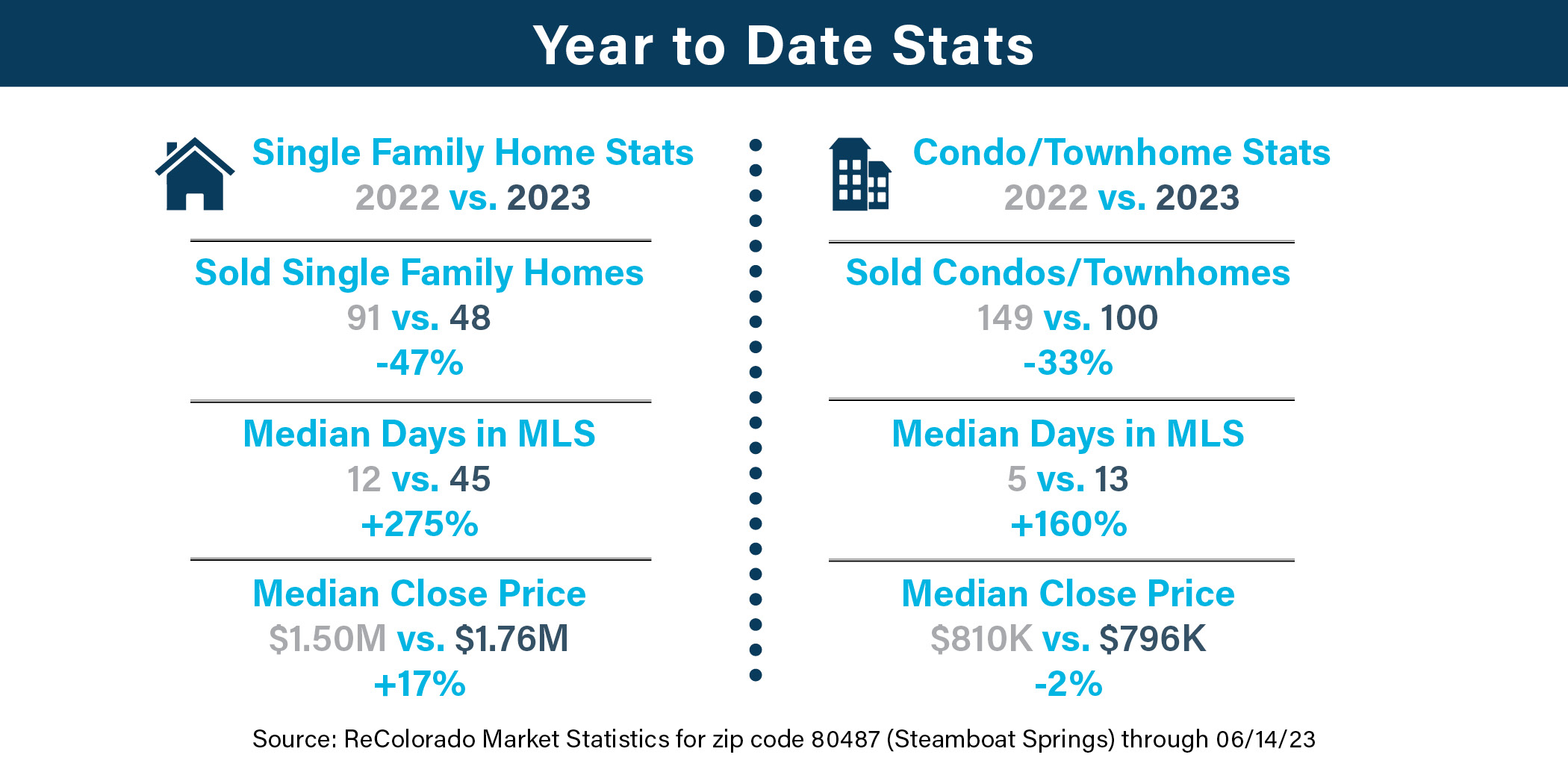

As of June 13, 2023, Routt County has 127 active residential listings. That’s up from 79 this time last month, and down from this time last year (120). The number of currently-pending listings (100) is up from this time last month (79), and also up from this time last year (69). Closed listings in May county-wide were up (64) compared to the month prior, March (49), and down compared to May of 2022 (81).

Median days on market remains aggressive at about 20 days in May 2023, compared with 16 days in April 2023. Average price-per-square foot in city limits is on par with the 2022 numbers, clocking in at approximately $650. The average closed price ratio for all property types is 98.6% and 99.7% in the city and the county, respectively.

Updated property valuations were mailed out to all Routt County property owners in early May. The deadline to appeal those property valuations was Thursday, June 8. If you missed the window to appeal, Routt County Assessor Gary Peterson said that the 2023 tax bill “will not be a direct correlation between tax liability and increase in value,” according to an interview with the Steamboat Pilot on May 12, 2023. In other words, “if a property went up in value about 50%, for example, the taxes will go up approximately 10% to 20%”, according to the article. You can find your tax estimate for 2023 on your notice of valuation.

On the national level, on June 14, the Federal Reserve paused its succession of interest rate hikes (the Fed has raised interest rates 10 times since March 2022). Reasoning that consumer inflation has gone from a high of 9.1% last June to 4% this May, the Fed stated that a pause in rate hikes was warranted. Yet the Fed also warned that because core inflation remained high, there may be more interest rate hikes later this year. The good news for mortgages: Historically, as inflation falls, so do home interest rates.

You might be asking: “Is now a good time to buy or sell a home for me?” Contact one of our experienced agents at The Group to help you understand the answer.

Comments